PaycheckCity: Guide to Smarter Paycheck Calculations

Understanding your paycheck should feel simple, yet many workers still find taxes confusing. PaycheckCity has become a trusted online tool that helps employees and small business owners estimate earnings with clarity. The platform focuses on accuracy, speed, and updated tax rules for each U.S. state.

In this guide, you will learn how paycheckcity works, who should use it, and why it remains popular in 2026. We also explain its calculators, payroll features, and real-world benefits in clear and simple language.

What Is PaycheckCity?

PaycheckCity is an online payroll and paycheck calculation service. It allows users to enter pay details and receive a clear breakdown of taxes and deductions. The site supports hourly wages, salaries, bonuses, and special payment types.

People rely on paycheckcity when planning budgets, checking employer pay stubs, or preparing payroll for small teams. The service reflects federal and state tax rules, which helps users avoid surprises.

Why PaycheckCity Matters in 2026

Tax laws change often, and workers want fast answers about take-home pay. PaycheckCity stays useful because it updates formulas to match current IRS guidance. The platform keeps its tools simple so even first-time users can get results.

Many freelancers and HR staff use paycheckcity to compare pay scenarios. They can adjust deductions, filing status, or benefits and see how net pay shifts in seconds

How PaycheckCity Works

The system asks for your gross income and job details. You then choose a state, filing status, and any benefits or retirement plans. The calculator processes this data and shows deductions for Social Security, Medicare, and income tax.

Results appear in a clean format that lists gross pay, total tax, and final net pay. This design helps users understand exactly where money goes each pay period.

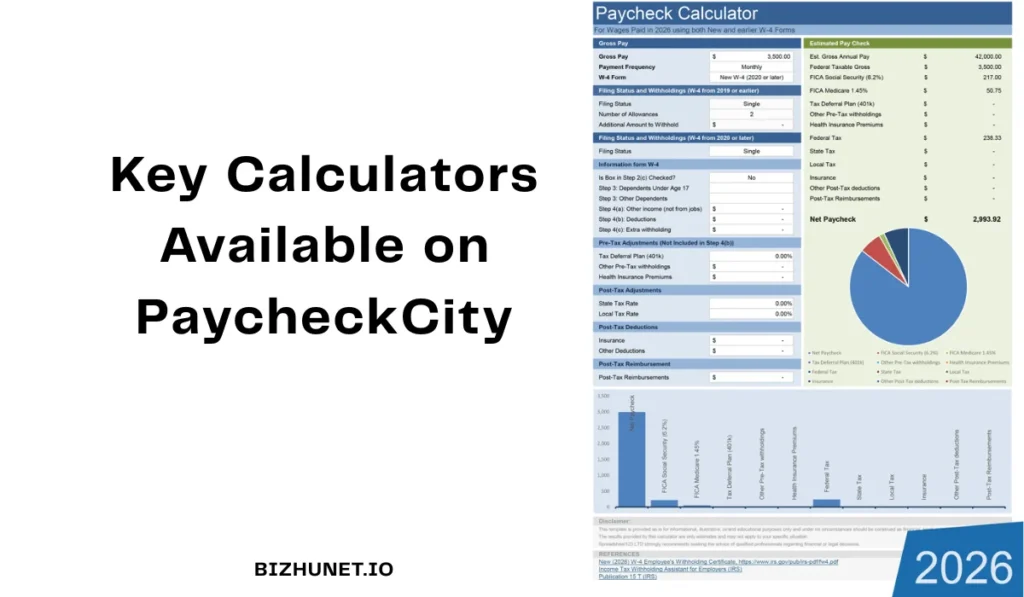

Key Calculators Available on PaycheckCity

PaycheckCity includes several tools that fit different pay types. Each calculator focuses on a specific income situation.

Read more: Crisis as catalyst

Salary and Hourly Pay Tools

These calculators work best for regular paychecks. You enter your rate, hours, and pay schedule. The tool then estimates taxes and net earnings for weekly or monthly cycles.

Bonus and Commission Calculator

Extra income can raise tax withholding. PaycheckCity offers a bonus tool that follows IRS supplemental wage rules. This helps workers avoid confusion when a big reward hits their check.

Net-to-Gross Calculator

Some users know what they want to take home. This calculator shows how much gross pay is needed to reach that amount. Employers often use it for special payments.

Payroll Services for Small Businesses

Besides free calculators, paycheckcity offers paid payroll software for companies. These tools handle employee pay runs, tax calculations, and reporting.

The payroll system creates pay stubs and year-end forms such as W-2 and 1099. Business owners still file taxes themselves, but the numbers come ready for submission

Who Should Use PaycheckCity?

Many types of workers benefit from these tools.

Employees use it to check if their pay looks right. Freelancers run scenarios before accepting contracts. Small firms rely on it to preview payroll costs.

Anyone who wants transparency around earnings will find paycheckcity helpful.

Main Features at a Glance

| Feature | Description | Who Benefits Most |

|---|---|---|

| Paycheck Calculators | Estimates net pay after taxes | Employees |

| State-Specific Rules | Adjusts for local tax laws | Multi-state workers |

| Bonus Tool | Handles supplemental wages | Commission staff |

| Payroll Software | Runs pay and reports | Small businesses |

| W-4 Guidance | Tests withholding choices | New hires |

Accuracy and Tax Updates

Accuracy matters when dealing with money. PaycheckCity updates its system each year to follow IRS changes and state tax rates. This keeps results close to real pay stubs.

Users still need to remember that calculators give estimates. Final pay depends on employer systems and benefits enrollment.

Ease of Use and Interface

The site focuses on clear fields and short forms. Each calculator walks users step by step through income and deduction options. Results load fast and appear in a simple chart.

This clean design makes paycheckcity friendly for people who do not work in finance

Read more: www-aeonscope-net

Comparing PaycheckCity With Other Tools

Many payroll calculators exist online, but some hide details or skip local taxes. PaycheckCity stands out because it shows each deduction clearly.

It also offers more free tools than many competitors. Users can test multiple scenarios without paying or signing up.

Common Mistakes to Avoid When Using PaycheckCity

People sometimes forget to include benefits like health insurance. That can change net pay by a lot. Others select the wrong filing status, which shifts federal withholding.

Always double-check inputs before trusting results. Accurate data leads to accurate estimates.

Real-World Uses of PaycheckCity

Workers often use paycheckcity before switching jobs. They compare offers by entering salaries from two companies. This helps them see which role brings home more money.

Employers test raises or bonuses with the calculators. They can predict costs before approving new pay plans.

Security and Privacy

The platform does not require account creation for basic calculators. That means users can test pay without sharing personal identity data. Paid payroll users must provide business details, which the service protects with standard security measures.

| Aspect | Strength | Limitation |

|---|---|---|

| Calculators | Free and detailed | Estimates only |

| Tax Coverage | Federal and state | Local taxes vary |

| Ease of Use | Simple layout | Needs correct inputs |

| Payroll Tools | Helpful for SMBs | Filing still manual |

Frequently Asked Questions

What is PaycheckCity used for?

It estimates take-home pay after taxes and deductions for U.S. workers.

Is PaycheckCity free?

Most calculators are free, but payroll software requires payment.

Does PaycheckCity include state taxes?

Yes, it adjusts results based on the state you choose.

Are PaycheckCity results exact?

They are close estimates, but final pay depends on your employer.

Conclusion

PaycheckCity remains one of the easiest ways to preview earnings and payroll costs in 2026. Its calculators give clear views of taxes, benefits, and net income. Workers and business owners trust the platform because it stays updated and simple.

If you want fast insight into your paycheck, PaycheckCity offers practical tools that save time and reduce stress. With careful inputs and realistic expectations, the service can guide smarter money decisions all year long.