MyGreenBucks Kenneth Jones: Informational Guide 2026

The topic MyGreenBucks Kenneth Jones has gained attention among readers who want

clear guidance on money control and smart financial habits.

This article explains the platform, the person behind it, and its purpose.

The content uses simple English and updated 2026 details for easy understanding.

Introduction to MyGreenBucks Kenneth Jones

The phrase mygreenbucks kenneth jones connects a financial education platform

with its founder and guiding voice.

The idea focuses on helping people manage money in a smart and responsible way.

The platform promotes budgeting, saving, and long-term financial thinking.

Money stress affects many families around the world.

MyGreenBucks aims to reduce that stress through education and simple tools.

The goal is to help users build better habits without complex finance terms.

Who Is Kenneth Jones?

Kenneth Jones is known as a financial educator

linked with the MyGreenBucks concept.

He shares practical ideas that everyday people can follow.

His approach avoids risky promises and focuses on steady improvement.

Kenneth Jones emphasizes learning before earning.

He believes strong knowledge leads to better financial decisions.

This mindset shapes the overall direction of MyGreenBucks.

What Is MyGreenBucks?

MyGreenBucks

is an informational platform focused on personal finance education.

It explains money topics in a clear and friendly style.

The platform does not act like a bank or investment firm.

MyGreenBucks mainly provides guides, tips, and learning resources.

It targets beginners who feel confused about money planning.

The content focuses on real-life money situations.

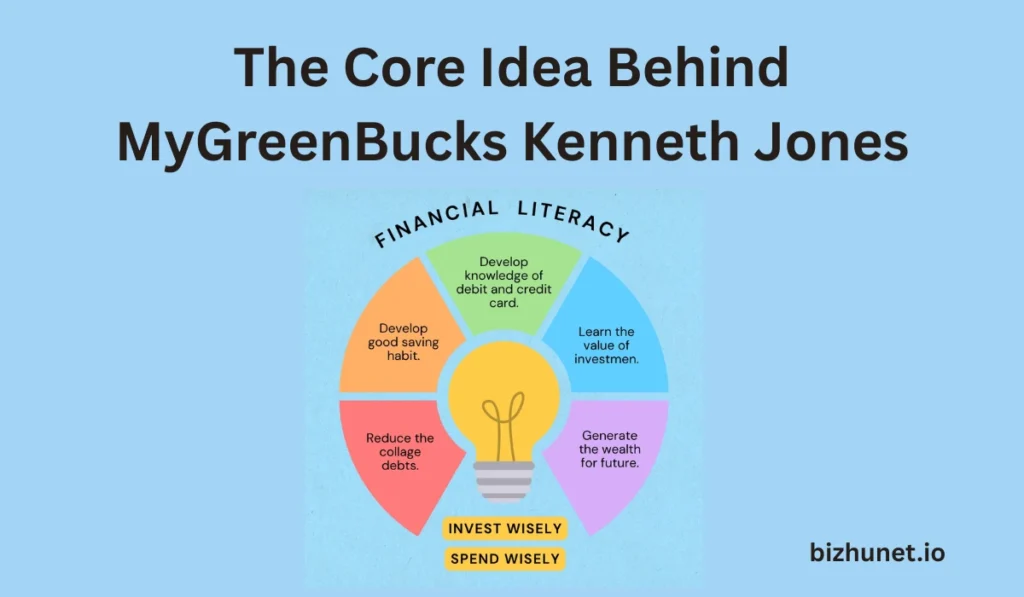

The Core Idea Behind MyGreenBucks Kenneth Jones

The core idea of mygreenbucks kenneth jones is financial clarity.

The platform encourages people to understand their income and expenses.

This understanding helps users avoid unnecessary debt.

Kenneth Jones promotes responsibility and patience in money matters.

Quick money schemes are discouraged throughout the content.

The focus remains on long-term stability and growth.

Early Development and Vision

The vision of MyGreenBucks started with a simple question.

How can people learn finance without fear or confusion?

Kenneth Jones answered this by simplifying financial language.

The early content focused on budgeting basics and saving habits.

Over time, the platform expanded to include mindset topics.

This growth helped reach a wider audience.

Educational Approach and Learning Style

The teaching style used in mygreenbucks kenneth jones content is direct.

Each topic is broken into small and clear explanations.

Readers can understand ideas without financial background.

The platform avoids heavy technical terms.

Examples are often based on daily life spending.

This approach supports learners of all ages.

Focus on Responsible and Green Thinking

The word “green” in MyGreenBucks suggests responsibility.

It represents mindful spending and long-term planning.

The platform encourages avoiding wasteful financial habits.

Responsible finance helps both individuals and communities.

Kenneth Jones highlights ethical choices in money use.

This mindset supports stable financial futures.

Read more: Make1m com luxury

Target Audience of MyGreenBucks

MyGreenBucks targets beginners in personal finance.

Students, young workers, and families benefit from the content.

The platform also helps people recovering from debt stress.

The language suits readers at a basic education level.

Complex charts and advanced formulas are avoided.

This keeps learning stress-free.

Features Commonly Associated With MyGreenBucks

The platform focuses more on education than tools.

Common features include financial guides and planning advice.

Some sections explain earning concepts in a simple way.

The content encourages readers to track spending manually.

This builds awareness of daily financial choices.

No unrealistic income promises are made.

Trust and Transparency in 2026

In 2026, transparency matters more than ever in finance education.

MyGreenBucks presents itself as an informational resource.

It does not claim to replace professional financial advisors.

Kenneth Jones stresses personal responsibility in money decisions.

Readers are advised to research before acting.

This honest approach builds trust.

Financial Philosophy of Kenneth Jones

Kenneth Jones believes money habits shape life quality.

Small daily choices create long-term results.

This philosophy drives all MyGreenBucks content.

He encourages learning from mistakes instead of fear.

Financial growth is shown as a gradual process.

This mindset helps readers stay motivated.

MyGreenBucks and Online Financial Literacy

Online platforms play a key role in financial education today.

MyGreenBucks fits into this digital learning trend.

It allows users to learn at their own pace.

The platform competes with many finance blogs.

Its strength lies in simplicity and clarity.

This makes it stand out for beginners.

Read more: Axurbain

Benefits of Following MyGreenBucks Content

Readers gain better money awareness over time.

They learn how to plan expenses realistically.

This reduces financial anxiety and confusion.

The platform also builds confidence in decision making.

Users feel more in control of their finances.

This emotional benefit is often overlooked.

Common Misunderstandings About MyGreenBucks

Some people expect fast earning results.

MyGreenBucks does not promote instant income.

It focuses on learning before earning.

Another misunderstanding is about investment advice.

The platform does not provide licensed investment services.

It remains educational in nature.

Key Information About MyGreenBucks Kenneth Jones

| Aspect | Details |

|---|---|

| Platform Name | MyGreenBucks |

| Founder | Kenneth Jones |

| Main Focus | Financial education |

| Target Audience | Beginners and families |

| Content Type | Guides and money tips |

| Risk Level | Informational only |

| Year Relevance | 2026 updated |

Role of MyGreenBucks Kenneth Jones in 2026

In 2026, financial stress continues to affect many people.

mygreenbucks kenneth jones remains relevant due to its simple approach.

The platform adapts to modern money challenges.

Rising living costs make budgeting more important.

MyGreenBucks addresses these real-life issues.

This keeps the content useful and timely.

Long-Term Value of Financial Education

Financial education builds independence and confidence.

People make fewer mistakes when they understand money.

MyGreenBucks supports this learning journey.

Kenneth Jones promotes lifelong learning.

Money skills need regular updates.

This mindset fits modern financial realities.

Challenges and Limitations

No single platform fits every financial situation.

MyGreenBucks offers general guidance only.

Complex cases require professional advice.

Readers must apply lessons responsibly.

Blind following is discouraged.

This honesty strengthens credibility.

Comparison With Other Finance Blogs

Many finance blogs use complex language.

MyGreenBucks keeps content simple and direct.

This makes learning easier for beginners.

The platform avoids aggressive marketing.

Education remains the main priority.

This approach attracts trust-focused readers.

Strengths and Weaknesses

| Strengths | Weaknesses |

|---|---|

| Simple language | Limited advanced topics |

| Beginner friendly | No personalized advice |

| Honest approach | Educational only |

| Clear philosophy | Not for expert investors |

Frequently Asked Questions

What is mygreenbucks kenneth jones about?

It is about a financial education platform and its founder.

The focus is on simple money management learning.

Is MyGreenBucks a financial company?

No, it works as an educational platform.

It does not offer banking or investment services.

Who should follow MyGreenBucks content?

Beginners who want clear money guidance benefit most.

Families and students also find it useful.

Is the information relevant in 2026?

Yes, the content addresses modern money challenges.

It focuses on habits that stay useful over time.

Final Thoughts

The concept of mygreenbucks kenneth jones centers on clarity and responsibility.

It avoids hype and focuses on real financial learning.

This makes it valuable for beginners in 2026.

By promoting steady habits, the platform supports long-term stability.

Kenneth Jones’s simple teaching style helps reduce money fear.

Overall, MyGreenBucks remains a helpful educational resource for mindful finance.